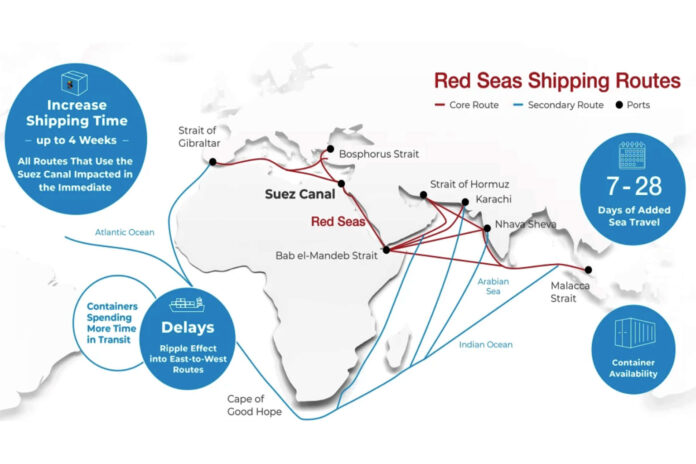

Since November 2023, Yemen-based Houthi militia have targeted cargo ships in the Red Sea, claiming solidarity with Palestinians in Gaza.

As tensions rise, 95% of vessels have rerouted around the Cape of Good Hope, adding 4000 to 5000 nautical miles and 15 to 20 days to journeys.

The implications are far-reaching, impacting freight costs, delayed deliveries, and potentially disrupting global supply chains. The sectors hit hardest, including refined petroleum, chemicals, plastics, and basmati rice.

The rerouting affects 20-25% of India’s total merchandise trade, particularly impacting cargo bound for Europe, the US East Coast, North Africa, and Russia.

What is the impact on Indian trade flowing through the Red Sea? After the attacks, major cargo shipping lines decided they would not operate on this route. Even small feeder vessels have of late stopped plying in these waters. Almost 90% of western hemisphere cargo, both inbound or shipped from India, that used to go through the Red Sea is now getting re-routed through the Cape of Good Hope, according to the Federation of Indian Export Organisations’ Director-General Ajay Sahai.

Whether exporting to Europe, the U.S. east coast and even to countries in North Africa, the longer route is being used. The remaining 10% of Indian import or export cargo is either not moving or using a transit facility. The impact of this move varies on the type of buyer-seller contract. If it is FOB (free on board), the freight burden is on the buyer, and in CIF (cost, insurance and freight) or C&F (cost and freight) contracts, the freight has to be borne by the exporter.

In cases of FOB, and where the buyers have comfortable inventory, they are asking the Indian exporter to hold back consignment. Likewise, exporters who have to bear the freight are requesting their buyers to allow them to hold the consignment given the increase in freight costs, which includes peak season surcharge and contingency surcharge. However, if there is zero inventory, the buyer would insist on shipment of the goods, according to Mr. Sahai. “Roughly 20-25% consignments are being held up.

Container Corporation of India is saying about 25% of its containers are being held back by Indian exporters. Everybody is hoping the situation will normalise shortly, but looking into recent developments we are still keeping our fingers crossed,” adds Mr. Sahai. While all consignments are likely to be impacted by the increase in freight cost — by up to six-fold in some cases — and the longer voyage time, the pinch would be felt most by low-value, high-volume cargo as well as perishables.

How does the crisis impact India’s imports? Besides the extra time taken on account of the longer route, the developments could make imports costlier and call for better inventory management. While the impact on some critical imports are being assessed, both import and export cycles have elongated, says Mr. Sahai. Also, the crisis could result in final products turning dearer. For instance, the Red Sea crisis could come in the way of any plans to reduce pump prices of petrol and diesel. Gross imports of crude oil and petroleum products as a share of India’s gross imports in value terms was 25.8% in 2022-23, and 22.6% in the first half of the current fiscal. In fact, India’s import dependence (based on consumption) in the April-September 2023 period was 87.6%, according to the government’s Petroleum Planning and Analysis Cell. Citing the turbulent situation, Petroleum Minister Hardeep Singh Puri said there was no plan to slash fuel prices.

Separately, in a note on the impact of the crisis on oil tankers, analytics firm Vortexa’s senior freight analyst Ioannis Papadimitriou observes that though freight rates for impacted routes have increased, this has not been reflected in the overall tanker market, implying that there is as yet no en masse re-routing taking place.

Additional war risk premiums in the Red Sea have been partially contributing to the freight-rate increases for the relevant routes, but this surcharge is significantly lower than the costs linked to re-routing via the Cape of Good Hope. Because of the current pricing dynamics, the tankers that are diverting are predominantly the ones chartered from companies announcing diversions as well as the ones operated by U.S. and Israel-linked entities.

What has been the response? The UN has said “no cause or grievance” could justify Houthi attacks against freedom of navigation in the Red Sea. The U.S. wants more support for the multi-national ‘Operation Prosperity Guardian’ it is spearheading to keep the sea lanes open and free of threats. India is closely watching the situation, and the Commerce Secretary is said to have held discussions with officials and trade bodies.

Any particular sector impacted? Commodities are the worst affected whether it be chemicals, plastic, petrochemicals, because margins are not there to absorb the hike in freight. For high value, low volume commodities airlifting is possible, but goods which are moved are generally large volume.

A spate of attacks on cargo ships in the Red Sea since November by the Houthi militia of Yemen has turned the quickest marine route linking Asia with Europe through the Suez Canal unsafe. The U.S. wants more support for the multi-national ‘Operation Prosperity Guardian’ it is spearheading to keep the sea lanes open and free of threats.