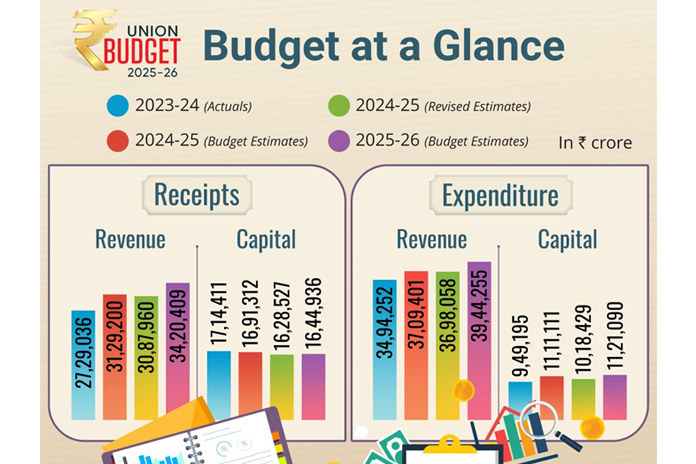

New Delhi: Union Finance Minister Nirmala Sitharaman presented the Union Budget 2025-26 in Parliament, estimating total receipts, excluding borrowings, at ₹34.96 lakh crore and total expenditure at ₹50.65 lakh crore. The fiscal deficit is projected at 4.4% of GDP, while gross market borrowings are estimated at ₹14.82 lakh crore. Capital expenditure is earmarked at ₹11.21 lakh crore, accounting for 3.1% of GDP.

The budget outlines major allocations for agriculture, MSMEs, infrastructure, and exports. The Prime Minister Dhan-Dhaanya Krishi Yojana will be implemented in partnership with states, covering 100 districts with low productivity and benefiting 1.7 crore farmers. The government has launched a six-year Mission for Aatmanirbharta in Pulses, focusing on Tur, Urad, and Masoor, with NAFED and NCCF procuring these pulses for four years. The loan limit under the Kisan Credit Card has been enhanced from ₹3 lakh to ₹5 lakh.

The Revamped Distribution Sector Scheme, with an outlay of ₹3 lakh crore, aims at power supply improvements and smart meter implementation. The PM Surya Ghar: Muft Bijli Yojana targets 40-45 GW rooftop solar capacity by 2027. The government has allocated ₹7,453 crore under the Viability Gap Funding scheme for offshore wind energy. The Green Energy Corridor has added 9,136 circuit km of transmission lines, with urban and rural electricity supply improving to 23.4 hours and 21.9 hours per day, respectively.

MSMEs will see an increase in investment and turnover limits by 2.5 times for classification. Customized credit cards with a ₹5 lakh limit will be issued to 10 lakh micro enterprises registered on the Udyam portal in the first year. A Fund of Funds with ₹10,000 crore will be set up for startups. A new scheme for five lakh first-time women, SC, and ST entrepreneurs will provide term loans of up to ₹2 crore in the next five years.

Infrastructure investment includes ₹1.5 lakh crore for 50-year interest-free loans to states for capital expenditure. The second Asset Monetization Plan (2025-30) aims to mobilize ₹10 lakh crore for new projects. An Urban Challenge Fund of ₹1 lakh crore has been announced for urban growth and water and sanitation projects. The Nuclear Energy Mission, with an outlay of ₹20,000 crore, will focus on research and development of Small Modular Reactors, with five indigenous SMRs expected to be operational by 2033.

The modified UDAN scheme will expand regional air connectivity to 120 new destinations and target four crore passengers over the next 10 years. A Greenfield airport in Bihar has been announced, along with expansion plans for Patna Airport and a brownfield airport at Bihta.

The budget allocates ₹20,000 crore for private sector-driven Research, Development, and Innovation, along with a Deep Tech Fund of Funds to support startups. The PM Research Fellowship will provide 10,000 fellowships for research in IITs and IISc. A National Geospatial Mission will be established to develop foundational geospatial infrastructure.

An Export Promotion Mission will be set up with sectoral and ministerial targets, while BharatTradeNet will be introduced as a unified platform for trade documentation and financing solutions. The FDI limit in the insurance sector will be raised from 74% to 100% for companies that invest their entire premium in India. The government will introduce an Investment Friendliness Index for states to promote competitive cooperative federalism.

Personal income tax exemptions have been raised under the new tax regime, with no tax payable on income up to ₹12 lakh. For salaried taxpayers, the exemption limit is ₹12.75 lakh, including the standard deduction of ₹75,000. The annual TDS limit on rent has been increased from ₹2.4 lakh to ₹6 lakh. Interest exemption for senior citizens has been doubled from ₹50,000 to ₹1 lakh.

On indirect taxes, seven tariff rates have been removed, leaving only eight, including zero. Basic Customs Duty has been fully exempted on 36 life-saving drugs and reduced to 5% on six others. Critical minerals such as lithium-ion battery scrap, cobalt powder, lead, and zinc have been fully exempted from BCD. The exemption on raw materials for shipbuilding has been extended for another ten years. The BCD on Interactive Flat Panel Displays has been increased from 10% to 20%, while BCD on Open Cells for displays has been reduced to 5%.

The Economic Survey 2024-25, presented alongside the budget, highlighted that India’s installed power capacity grew by 7.2% year-on-year, reaching 456.7 GW, with renewable energy contributing 47%. The energy demand-supply gap has reduced to 0.1%. The Jal Jeevan Mission has been extended until 2028 with enhanced funding.

The budget focuses on infrastructure, investment, and economic growth, with key allocations across agriculture, MSMEs, exports, and technology-driven sectors.